BATH — A state tax break for Bath Iron Works received initial approval Tuesday in the state House of Representatives, passing 117-31.

The approval of LD 1781 follows a March 6 vote of 11-2 by the Legislature’s Joint Committee on Taxation that the bill “ought to pass as amended.” The Senate was expected to vote Wednesday, March 28, and the House could vote for final enactment the following day, according to legislative aide Dan Ankeles.

The Senate then gets a vote on final enactment before the bill would go to Gov. Paul LePage.

LD 1781, proposed to renew a tax incentive first passed in 1997, would provide the shipyard an income tax incentive in return for making investments in the facilities and preserving jobs.

As originally proposed, BIW would receive an annual refundable corporate income tax credit, for up to 20 years that equals 3 percent of its $100 million qualified investment. The credit would have been capped at $60 million, or 3 percent of $100 million, over the course of 20 years.

To qualify, BIW had to invest at least $100 million in the facility and preserve at least 5,000 jobs. The shipyard reports having about 5,700 employees.

The Joint Committee on Taxation recommended the bill’s passage, but with the tax break capped at $45 million, or $15 million less than initially proposed.

In the incentive’s first phase (years 1-10), BIW would make a $100 million investment, receiving as much as $3 million a year in return, up to $30 million. In the second phase (years 11-15), the shipyard would make a second $100 million investment, receiving up to $3 million back a year, capped at $15 million.

The tax break would total $45 million over 15 years for a $200 million investment, according to bill sponsor Rep. Jennifer DeChant, D-Bath. Because she is the sponsor, the bill was first voted on in the House.

“I was proud to join my colleagues on both sides of aisle in supporting Maine’s shipbuilders,” DeChant said in a statement. “Bath Iron Works is the last union shipyard on the east coast. It supports over 5,000 good manufacturing jobs. I’m grateful that both BIW and organized labor were willing to work with us to make sure this tax credit comes with taxpayer safeguards, real guarantees about investment and hiring and a way to review and revoke the credit if it doesn’t help Maine workers.”

Opponents of the bill have noted the robust health of BIW parent company General Dynamics, and compared the tax break to “corporate welfare” at a time when funds could be used to address problems in education and state infrastructure.

Bruce Gagnon, coordinator of the Global Network Against Weapons & Nuclear Power in Space, said earlier this month that while $45 million is “chump change” for GD, “to the state of Maine it’s a lot of money when we have so many needs.”

Alex Lear can be reached at 781-3661 ext. 113 or alear@theforecaster.net. Follow him on Twitter: @learics.

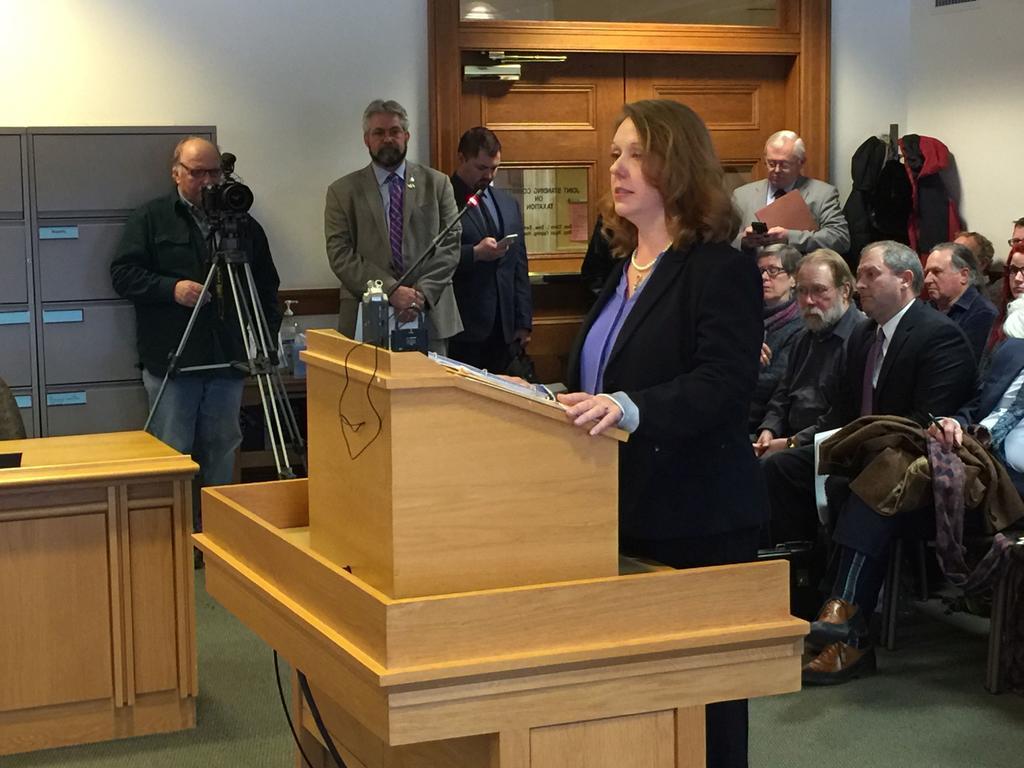

Rep. Jennifer DeChant, D-Bath, is lead sponsor of LD 1781, which would grant Bath Iron Works a $45 million tax break over 15 years. The state House of Representatives granted the bill initial approval Tuesday, 117-31.

Comments are no longer available on this story