Development in southern Maine continues to be strong, although somewhat tempered compared with the last two years. That was the takeaway from a daylong conference for real estate and development professionals Thursday at the Holiday Inn by the Bay. Presenters talked about trends they saw last year in residential, office, industrial, hospitality and retail real estate sectors, and forecast what they think 2019 will hold.

RETAIL

Maine retailers had a good year in 2018, despite the gloom-and-doom forecast nationally for brick-and-mortar stores, said Karen Rich, a broker with Malone Commercial Brokers.

Maine retailers had a good year in 2018, despite the gloom-and-doom forecast nationally for brick-and-mortar stores, said Karen Rich, a broker with Malone Commercial Brokers.

Of note were significant increases in lease rates for retailers in the Greater Portland market, which saw spikes ranging from 8 to 19 percent.

But there are signs of change. In 2016 and 2017, retail vacancies in downtown Portland were snapped up immediately, but last year they did not fill up as quickly.

Traditional brick-and-mortar retailers are adapting new, experiential strategies to get their products to customers, Rich said, such as technology that allows a customer to try out a product virtually before buying it. For instance, a customer can download a homegoods store app and then superimpose a lamp they are thinking of buying right onto an image of their own living room.

“It’s no longer us versus them – bricks-and-mortar versus e-commerce,” Rich said. “As e-commerce becomes a larger part of our buying habits, retailers are employing omni-channel strategies.”

Some, however, may not navigate the change.

Rich said she expects Sears stores will close this year, and their spaces filled with new tenants.

INDUSTRIAL

Greater Portland’s industrial sector continues to be tight, but not as tight as last year when the combined vacancy rate of Portland area properties was a mere 1 percent. That rose to about 3.5 percent in 2018.

Also of note, leases and sales of industrial properties to marijuana entrepreneurs took a hiatus in 2018, with few transactions, said Justin Lamontagne, a broker with NAI Dunham.

Among factors limiting the new commercial leases is general economic uncertainty and a chronic labor force shortage that prevents companies from expanding, Lamontagne said.

“If you don’t have the bodies to fill the real estate, you’re not going to lease the real estate,” he said.

The decrease in activity helped stabilize lease rates, which had been growing steadily since 2012. Rates in Greater Portland last year averaged about $6.75 per square foot, down from the nearly $7 per square foot in 2017.

Despite the relative lack of available industrial space, investment properties were in high demand, Lamontagne said. Three investment properties he cited in his presentation showed cap rates of between 8 and 8.5 percent, indicating solid returns for the investors.

OFFICE

Like industrial properties in 2017, Class A office space in Portland’s downtown last year registered a 1 percent vacancy rate. Now the area is in the midst of a building boom, with more than 340,000 square feet of new office space under construction, led by new headquarters for Wex and VetsFirstChoice/Covetrus.

Nate Stevens, a broker for The Boulos Co., expects the overall vacancy rate for office space to rise to nearly 5 percent this year, a far cry from the 10 percent vacancy rates for Portland office space from 2010-12.

Sales of office buildings remained low, with more sales in 2016 than the last two years combined, Stevens said. Although sales volume was low, the value of the transactions was fairly high, he added.

“If it is a performing asset, it is going to sell,” Stevens said.

RESIDENTIAL

RESIDENTIAL

Despite relatively flat home-buying activity over the last three years, the median price of homes in Maine rose from $200,000 in 2017 to $215,000 last year. That increase is especially dramatic in Cumberland County, where a typical single-family home sold for $285,000 in 2017 and $307,250 last year, according to data presented by Dava Davin of Portside Real Estate Group.

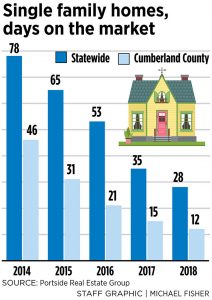

Reflecting tight inventories across the state, the number of days a house was on the market also dropped dramatically over the past four years – from 78 days in 2014 to 28 days in 2018. Again, Cumberland County saw more frenzied activity. A house on the market in 2014 typically sold in 46 days but was only on the market 12 days in 2018.

HOSPITALITY

Maine’s hotel industry saw another year of revenue growth in 2018, even as the number of guests stayed flat.

Hotels in Portland and York County anchored the industry, with annual daily room rates and revenue per available room that outpaced national averages.

“Demand for Maine is strong and continues to be strong,” said Steve Hewins, president and CEO of HospitalityMaine.

York County, including beach destinations like Ogunquit and Wells, is the “best success story in the state,” Hewins added.

Room rates in the region averaged $164 a day, 19 percent above the state average and hotels made about $95 a room, about 14 percent over average state revenue, according to figures from STR, a hospitality data firm.

The Portland area, in comparison, has the strongest year-round hotel market in the state. Daily rates topped out about $154 last year, 19 percent above the state average. Hotels earned $109 per room, about 26 above the rest of the state. With room prices hovering around $400 a night during the summer in some properties, Portland is one of the most expensive places to stay in the country, on par with Washington, D.C., and San Francisco, Hewins said.

Business Editor Carol Coultas contributed to this report.

J. Craig Anderson can be contacted at 791-6390 or at:

canderson@pressherald.com

Twitter: jcraiganderson

Comments are no longer available on this story