Lunar New Year is supposed to be the busiest time of the year for Tom Adams, whose company, Maine Coast, used to sell millions of pounds of lobster to China.

But the U.S.-China trade war has shut Maine Coast out of that market.

His former customers in China now buy their lobster from Canada, where dealers can sell a hard-shell version without the 25 percent import tariff. On a snowy Wednesday morning, on what should have been his busiest shipping day of the year, Adams waved at stacks of boxed lobsters waiting to be loaded on cargo trucks at his newly expanded York facility and sighed.

“Last year, all of this and more would’ve been headed to China,” he said. “But now, we’re lucky if any of them are.”

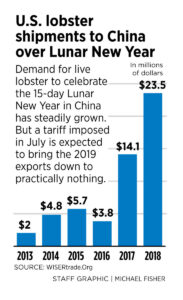

Maine lobster dealers are struggling to manage the fallout from the U.S.-China trade war. Before the tariff, China was the second biggest importer of U.S. lobster, buying $128.5 million worth of it in 2017. The U.S. was on track to double its lobster sales to China before the tariff initiated by President Trump hit in July, according to trade data. Since then, U.S. lobster exports have all but dried up.

For example, Adams lost 90 percent of his China business, which used to represent 22 percent of his sales.

At no time is the loss of the China market felt more keenly than at Lunar New Year, when China’s appetite for U.S. lobster had been strongest. Lobster is often served on Lunar New Year’s Eve, when families make elaborate feasts full of food that represents what they seek in the coming year, such as wealth and good fortune.

In 2018, China imported $23.5 million of U.S. lobster in February — more than at any other time of the year, and more than most countries buy in a calendar year. Stephanie Nadeau, a live lobster dealer from Arundel who used to sell $100,000 of lobster a day to China, has not sold a single holiday lobster to China this year. She is still selling February lobster in Hong Kong and Singapore, which have large Chinese populations that celebrate Lunar New Year, but Nadeau is shut out of the China holiday market. The tariffs have forced her to layoff workers and run her packing plant at 75 percent capacity.

“I made hay while the sun shined,” Nadeau said. “Trump has successfully blotted out my sun.”

BAD TIMING

Adams is faring a little better with the Chinese market. Some of his former customers in China will sometimes call him when the supply of Canadian lobsters or cargo space on flights between Canada and China is strained. For example, a few of the boxes in that 7 a.m. run out of York Wednesday were bound for Guangzhou, a sprawling port city northwest of Hong Kong. The rest of the 10,000-pound shipment was headed to holiday feasts in Taiwan and Hong Kong.

But the tariffs hit Maine Coast at a bad time: Adams had paid for but not yet completed a $1.3 million expansion of the facility, as well as an automated packaging line. A month before the tariffs were announced, Maine Coast hired two new salespeople to cater to the Chinese market: a Mainer who lived in Beijing for seven years and is fluent in Mandarin and a Cantonese-speaking Chinese native who moved from Hong Kong to Boston a year ago so his children could attend college.

“It’s been nerve-wracking to make these investments in a year when we ended up having so many adversities, but that’s the risk of being proactive,” Adams said. “We had been predicting 15 percent growth, and that’s on top of several years of 20 and 30 percent growth. Then the tariffs hit, and we had to really kill ourselves to essentially remain flat. We’re a little ahead on revenues, a little high on expenses and a little low on volume.”

NEW MARKETS

Like many in the lobster industry, Adams didn’t want to share his company’s exact profits, but he would talk about how things have changed since July. The total volume of lobster that Maine Coast sold fell about 3 percent in 2018, down from a peak of 7.3 million pounds a year. In the past, about half of its Lunar New Year sales were to China. This year’s totals aren’t available yet, but so far, Adams can count the number of Chinese orders on one hand.

Jeff Bennett, who follows China trade issues for the Maine International Trade Center, said the industry is aggressively seeking new markets for Maine lobster, but replacing the loss of Chinese markets is daunting.

“We are encouraged that the administration continues its trade talks with China, but we need to get back to a level playing field as quickly as possible,” he said.

Although China had been its single biggest export destination, Maine Coast had already been building up its market share in other Asian markets, such as Hong Kong, Korea and Vietnam, before the tariffs hit, Adams said. Since the tariff shut down China, Adams has redirected his sales and marketing staff to focus their efforts on building those markets, where the middle classes are still small compared to China but poised on the brink of rapid growth.

Like China, these countries have a love of buying and preparing live seafood, which makes it easier for Adams to introduce a new product like lobster. He and his staff have visited all three of these countries over the last year, talking to buyers who sell his live lobster out of large open-air tanks in supermarkets in Vietnam or restaurateurs who serve them up in Korean malls, including the Big Guys Lobster chain in Seoul that the founder named in honor of himself and Adams.

Adams has directed his new hires, like returning Mainer Britt Langford, to focus efforts on these nations, but also to expand the Maine Coast footprint in American cities with big Chinese populations, like San Francisco, Los Angeles, Chicago, New York and Atlanta, where their language skills and knowledge of the culture will resonate with Chinese nationals and Chinese-American buyers. The strategy is working, he said. Most of the lobster that left on a 4 a.m. box truck out of York on Wednesday ended up in Chinatowns across California. But it’s slow.

“This Chinese New Year, our China sales are a fraction of what they’ve been over the last five years,” he said. “We’ve increased our orders to Hong Kong, Taiwan and Vietnam, with Hong Kong being our biggest customer now, but that increase does not make up for the loss of Chinese market share. Even big growth in small markets can’t make up for the loss of China in sheer volume.”

And developing the new markets has come at an increased cost – more travel and more trade show and marketing expenses, Adams said.

The need to replace the Chinese market has been on the forefront of everyone’s mind, causing untold stress and anxiety, he said. While Adams said that he himself is financially secure enough to ride out the tariffs, he knows that many of his employees had been counting on the bonuses and the overtime that had become the norm at Maine Coast during the China lobster boom to pay their bills and plan their future.

“We worked hard and found a way to grow our sales enough to absorb the tariff, and that work should continue to pay off over time,” Adams said. “It takes time to grow a new market. Five or six or seven years to hit the sweet spot, that time when it’s good, but not so good that everyone else jumps in. We should continue to see growth in our (non-China) Asian sales, enough to keep us going, even growing, until China’s back.”

Penelope Overton can be contacted at 791-6463 or at:

poverton@pressherald.com

Twitter: PLOvertonPPH

Comments are no longer available on this story