BATH — A state tax break for Bath Iron Works could go to votes in the Maine House and Senate by the end of this month, according to the bill’s sponsor.

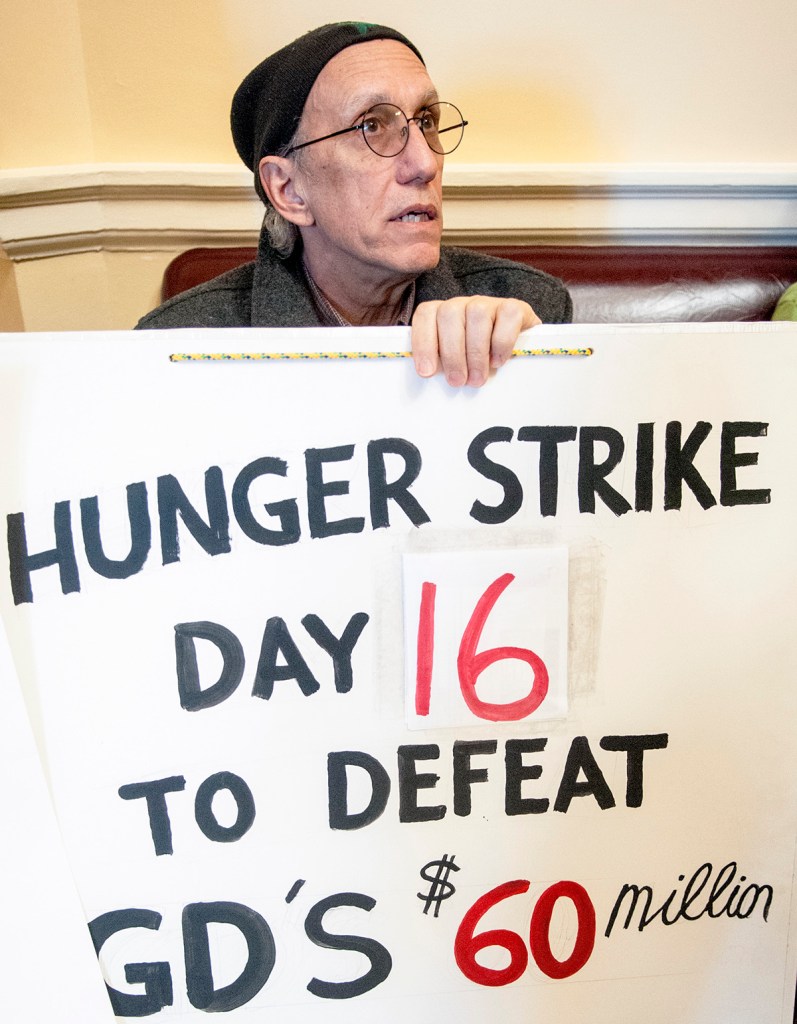

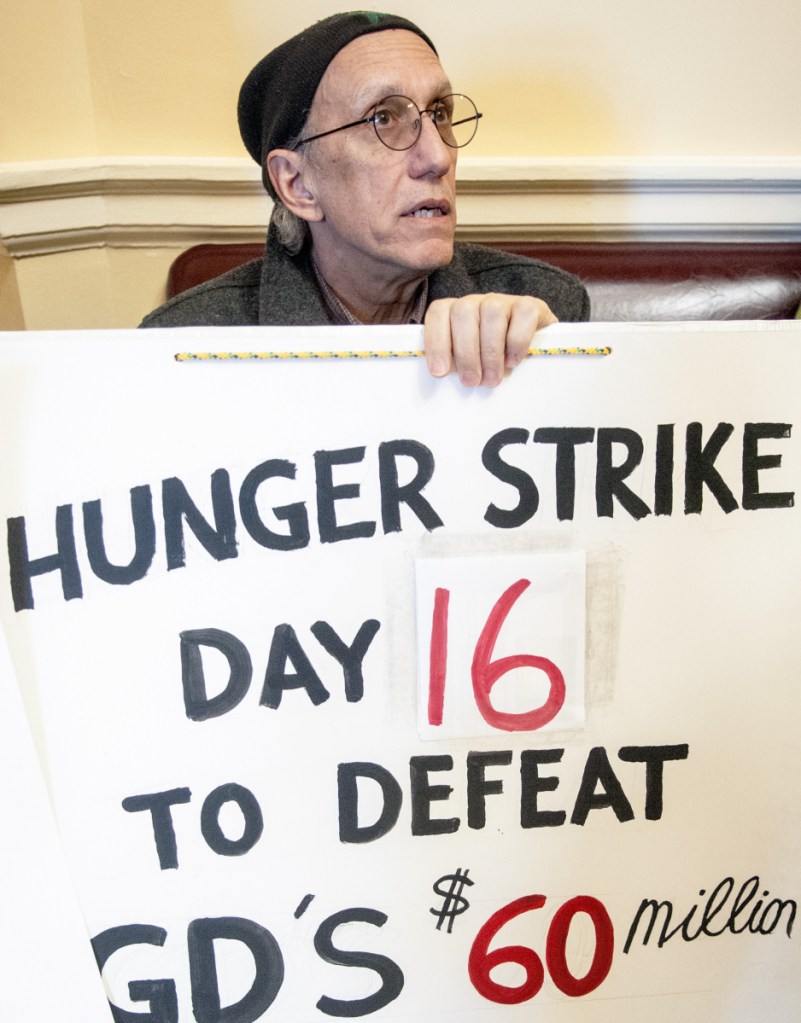

In the meantime, Bath resident Bruce Gagnon, an outspoken opponent of L.D. 1781, said Tuesday he would end his hunger-strike protest of the bill after 37 days. He had planned to continue until the bill is voted up or down, but concluded it for medical reasons.

The bill, which would renew a tax incentive first passed in 1997, would give the shipyard an income tax break in return for making investments in its facilities and preserving jobs.

As originally proposed, BIW would receive an annual refundable corporate income tax credit capped at $60 million and spread over 20 years.

To qualify, BIW had to invest at least $100 million in its facility and preserve at least 5,000 jobs. The shipyard reports having about 5,700 employees.

The Legislature’s Joint Committee on Taxation voted 11-2 that the bill “ought to pass,” but with the tax break capped at $45 million over 15 years, said Rep. Jennifer DeChant, D-Bath, the bill’s sponsor.

In the incentive’s first 10 years, BIW would make a $100 million investment and receive as much as $3 million a year in tax breaks, up to $30 million. In the next five years, the shipyard would make a second $100 million investment and receive up to $3 million back a year, with a cap of $15 million.

The bill now heads to the Maine House.

“The process of L.D. 1781 has been a textbook case of developing public policy,” DeChant said March 15. “At the first work session, I provided amendments that helped set the table for the committee’s consideration. Then the Tax Committee did a deep dive into evaluation, consistency and development of tax policy with bipartisan support. I am pleased with the process.”

Investments in the shipyard would include construction, modernization, improvement or expansion, DeChant said.

“BIW must compete for work against a shipyard which is well-equipped and aggressively seeks to win work that might otherwise come to Bath,” Lisa Read, a shipyard spokeswoman, said in January in reference to Ingalls Shipbuilding. “The tax credit will benefit the shipyard by lowering the cost of doing business in Maine and helping BIW’s competitive position relative to its competitor in Mississippi.”

Gagnon, coordinator of the Global Network Against Weapons & Nuclear Power in Space, said after a news conference March 15 that he has been pleased to see the opposition to what he calls “corporate welfare.”

Although $45 million is “chump change” for BIW-owner General Dynamics, “to the state of Maine it’s a lot of money when we have so many needs,” such as transportation infrastructure improvements, he said.

The 25 percent tax break reduction is “a positive sign in that (legislators) felt the pressure from the public to do something,” Gagnon said. He noted that there have been more than 100 letters to the editor and opinion columns in 25 Maine newspapers on the subject, “which indicates to me a widespread support to oppose this bill across the state.”

On March 15, the 32nd day of his anti-tax-break hunger strike, he said, “I’m doing pretty well. I’m getting weaker, obviously.”

Shunning solid foods and ingesting only juices and broth, Gagnon said he had lost 16 pounds, dropping from 175 to 159.

“My high school weight was 155,” he noted, adding with a chuckle. “I’ve got a running joke: What 65-year-old man wouldn’t want to have his high school weight again?”

Asked about the first thing he wants to eat after the Legislature votes, Gagnon replied, “I’ve thought of that many times.” Having spent 30 years in Florida, Gagnon said, he has his eyes on some grits. A small amount, topped with two poached eggs, with a piece of toast.

“I can’t wait,” he said.

But after a bad night Monday and continuing to feel ill Tuesday, he consulted with medical advisers and opted to end the strike by eating one quarter of a boiled potato and one soft-boiled egg.

Gagnon and others will continue standing in a third floor State House hallway every Tuesday and Thursday while the bill remains before the Legislature.

Alex Lear can be contacted at 781-3661, ext. 113, or at:

alear@theforecaster.net

Twitter: learics

Send questions/comments to the editors.

Comments are no longer available on this story