AUGUSTA — More opponents than supporters of a renewed $60 million tax break for Bath Iron Works spoke Tuesday at a Statehouse public hearing.

The Legislature’s Joint Committee on Taxation heard nearly three hours of testimony on LD 1781, which would renew a tax incentive first passed in 1997.

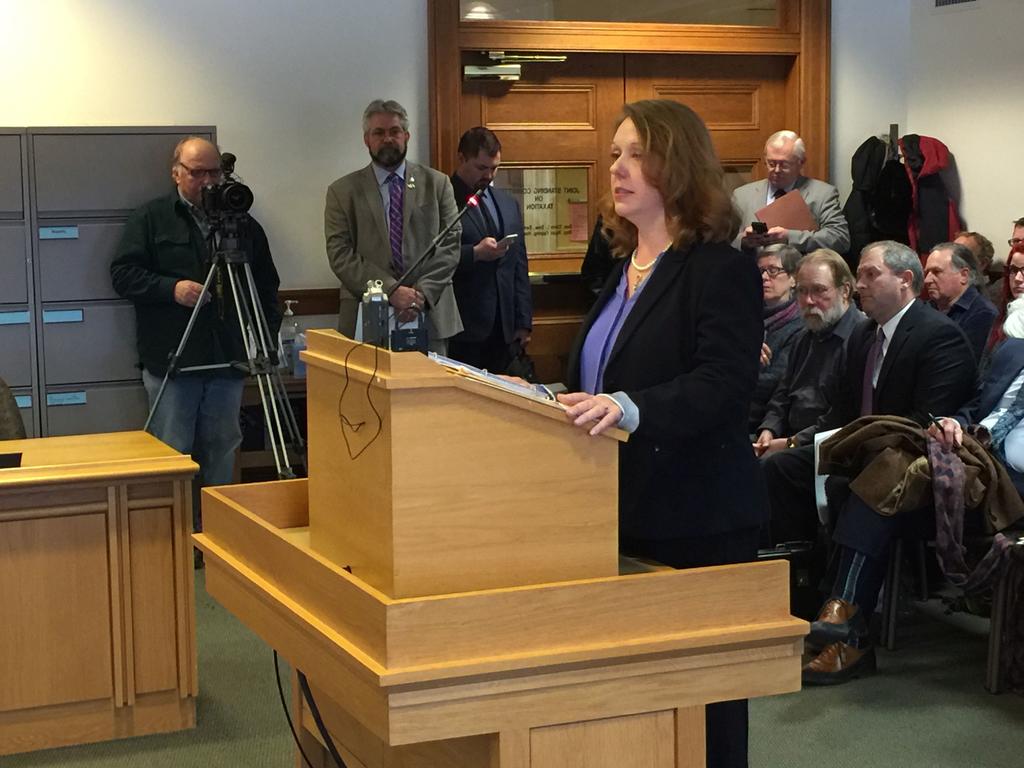

The timing of a work session for the bill could be determined by the end of February, and sponsor Rep. Jennifer DeChant, D-Bath, said she expects a vote before the current Legislative session ends in June.

“This credit is meant to reduce costs and encourage investments to boost the competitiveness of Maine’s shipbuilding industry, reducing the likelihood of a sudden wave of layoffs and better insulating our region from the sometimes-destructive ebb and flow of the world economy,” DeChant said in a statement Jan. 25.

“BIW is an economic driver to our state,” she said Tuesday, noting that other large Maine corporations such as Idexx and L.L. Bean also receive tax incentives.

The shipyard’s only customer is the U.S. Navy, and its primary competitor is Ingalls Shipbuilding in Mississippi, which is “nicely incentivized” by its state, DeChant added.

But opponents of the bill noted the robust health of BIW parent company General Dynamics, and compared the tax break to “corporate welfare” at a time when funds could be used to address problems in education and state infrastructure.

“This bill is nothing more than a $60 million gift for General Dynamics,” John Morris of New Gloucester told lawmakers. “… They don’t need $60 million; I don’t think they need 60 cents. They’re awash in money.

When it comes time to vote on the bill, “are you going to vote for corporate welfare, or are you going to stand up for the people of Maine?,” he asked the Taxation Committee.

LD 1781 would provide the shipyard an income tax incentive in return for BIW making significant investments in its facilities and preserving thousands of jobs. BIW would receive an annual refundable corporate income tax credit, for up to 20 years, that equals 3 percent of its $100 million qualified investment, Lisa Read, a shipyard spokeswoman, said Jan. 25.

The credit would be capped at $60 million, or 3 percent of $100 million, over the course of 20 years.

To qualify, BIW must invest at least $100 million in its facility, and preserve at least 5,000 jobs. The shipyard currently reports having about 5,700 employees.

BIW spokesman David Hench on Monday declined to discuss specifically how the shipyard would invest the funds. He said doing so “could provide our competitor information we’d rather not share with them.”

An existing 20-year tax credit, which the Legislature approved in 1997, expires this year, and LD 1781 would continue it. The renewal would run from 2019-39, as long as BIW makes the required investment.

The 1997 bill, which also established a $60 million ceiling, called for a $200 million investment. The new one stipulates half that amount; BIW ended up investing about $500 million, Read said.

Asked about the 1997 bill during a tour of BIW Jan. 26, U.S. Sen. Angus King, I-Maine, called signing it during his term as governor “one of the best things I ever did.”

“If we hadn’t done that, Bath Iron Works would not be here today,” he said in a video posted by WGME, noting that the funds were used to create a land-level launch facility, without which the shipyard could not have competed in subsequent years.

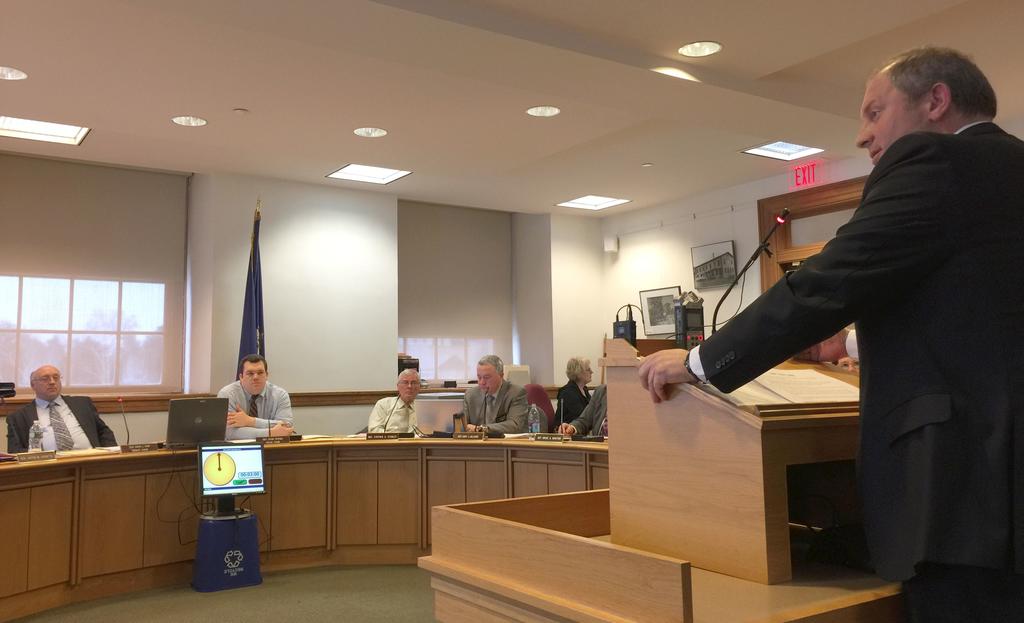

John Fitzgerald, BIW vice president and general counsel, echoed the benefits of that bill Tuesday. “I believe we delivered on the value that was hoped for,” he said, referring to the $500 million investment.

Without the launch facility, the shipyard would not have secured Navy contracts to build Zumwalt-class destroyers, Fitzgerald said.

“If we win work, that’s how we keep people employed,” he said. “We’re trying to win work.”

Read said $100 million in new investments would happen in 2019 or 2020. Those investments include construction, modernization, improvement, or expansion at the shipyard, according to DeChant.

LD 1781 stipulates that BIW must maintain a workforce of 5,000 during the 20 years, but allows for two exception years. The shipyard would not receive a full credit during those periods.

“If employment drops, there is a graduated scale that reduces the credit by increasing percentages, but BIW still has to have enough employees on the payroll to have $6 million in Maine income tax withholding to get a credit in any amount,” Read said.

If BIW’s employment drops to 4,000, for example, its credit would accordingly shrink to 60 percent, according to the bill.

“Just to maintain our workforce through retirements and attrition,” Read added, “BIW has hired 2,000 employees since 2014 and plans to hire up to 2,000 workers over the next five years.”

On the other hand, if BIW has at least 5,250 employees, its credit for that year would increase 110 percent.

“BIW must compete for work against a shipyard which is well equipped and aggressively seeks to win work that might otherwise come to Bath,” Read said, referring to Ingalls Shipbuilding. “The tax credit will benefit the shipyard by lowering the cost of doing business in Maine and helping BIW’s competitive position relative to its competitor in Mississippi.”

Read called BIW “a significant economic engine” for Maine, with a payroll of more than $350 million a year, as well as $45 million paid each year to companies in the state for “goods and services.”

“With our ever-changing economy, the give and take of increased globalization and the growing number of jobs being replaced by automation and technology, my top focus during my time in the Legislature has been supporting both the preservation and creation of jobs across our heritage industries, including shipbuilding and construction,” DeChant said.

Much of Tuesday’s hearing consisted of testimony from people opposed to BIW receiving another tax break, particularly in light of the health of its parent company. General Dynamics ranks 100th on the Fortune 500 list of the largest public companies in the U.S., and “is the world’s third largest defense contractor after Lockheed Martin and Boeing,” according to fortune.com.

“They are already profiting from recent corporate tax cuts,” Alice Bolstridge of Presque Isle told lawmakers. “They make their profits by making defense products taxpayers pay for. A large profit margin is built into their defense contracts. And now they’re asking for an additional $60 million in Maine taxpayer subsidies for Bath Iron Works.”

Bolstridge expressed her respect for BIW’s workers, but noted that Maine needs that $60 million to improve the quality of education, provide health care for everyone, fight the opioid epidemic, fix its “crumbling infrastructure,” and clean up its environment.

“I would gladly pay my tax dollars for these needs,” she added. “This bill serves greed, not need.”

Cushman Anthony of Yarmouth, a former legislator, agreed that Maine needs the tax money for a multitude of purposes.

“There are many worthy legislative proposals which will end up on the appropriations table,” he said. “We must ensure that there are adequate funds available for the most pressing of those needs. Passage of this bill would diminish what we can spend on other more important things.”

DeChant, who said she has heard concerns from her constituents about the legislation and the idea of extending BIW’s tax credit, said, “I agreed that we needed a better way to verify that our hard-earned tax dollars were being spent on Maine workers and that the credit was serving the purpose for which it was intended.”

As a result, she said she plans to offer an amendment that would “strengthen annual reporting requirements within this bill to ensure the tax credit is spurring job growth and strengthening our state economy.”

Alex Lear can be reached at 781-3661 ext. 113 or alear@theforecaster.net. Follow him on Twitter: @learics.

Rep. Jennifer DeChant, D-Bath, is lead sponsor of LD 1781, which would grant Bath Iron Works a $60 million tax break over 20 years. She presented her case Tuesday, Jan. 30, in Augusta before the Legislature’s Joint Committee on Taxation.

John Fitzgerald, BIW vice president and general counsel, speaks to the Maine Legislature’s Joint Committee on Taxation Jan. 30 about the importance of a proposed $60 million tax break for the shipbuilder.

Bruce Gagnon of Bath was among several people Jan. 30 to testify against a proposed tax break for Bath Iron Works.

Comments are no longer available on this story