When Suna and Robert Shaw bought their previous home in Windham in 2004, the process was akin to taking a leisurely stroll.

The couple took their time, visiting the home they would eventually purchase on three occasions before making a decision. The house had been on the market for six months.

But this year, the Shaws’ search for a larger home in Windham to accommodate their growing family played out quite differently. It felt more like a breakneck sprint with several false starts.

“Every time we found one we wanted to see, it was already under contract,” Suna Shaw said. “There were at least three that we really, really liked that were under contract before we could get a look at them.”

The Shaws eventually did place a winning bid on a home. They paid $288,000 for a 2,100-square-foot, five-bedroom house – $3,000 above the list price. Other prospective buyers in southern Maine’s tight housing market have not been so lucky.

The shortage of available homes for sale in southern Maine is forcing home buyers to check frantically for new listings each week, dash to the open house for each property and submit their offer immediately if they hope to have any chance, according to buyers, sellers and their real estate brokers. It also has pushed prices upward and led to some irrational market behavior.

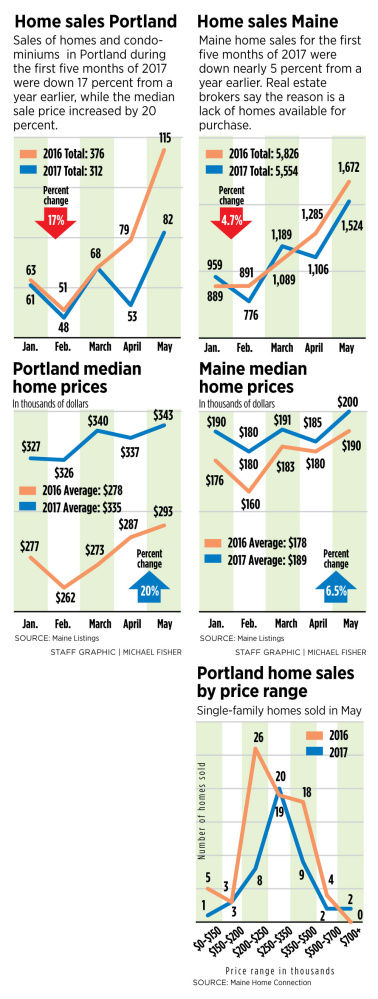

Portland seems to have the greatest imbalance of supply and demand. The median sale price in May for a home in Portland was $343,000 versus the state average of $200,000, while a home for sale in metro Portland spent an average of 43 days on the market compared with 81 days in Lewiston-Auburn and 104 days in Bangor.

The tight housing market is great for sellers but extremely frustrating for buyers. Some buyers have simply chosen to give up and continue renting after months of failed attempts to buy a home.

Aspiring home buyer Seth Adams of Topsham said that after three months of effort, he is no closer to obtaining a house in Portland than when he started. Adams, who recently got married, said he has looked at everything listed in his price range of under $250,000, including a tiny 675-square-foot home that was priced at nearly $200,000.

“It’s crazy. We really wanted a house of our own, but with the way the market is right now, it looks like that’s not going to happen,” Adams said. “We’re most likely going to have to stick with renting, unfortunately.”

PEOPLE HANGING ON TO PROPERTIES

Portland real estate broker Michael Hitz of Maine Home Connection said home sales during the first five months of 2017 were down 17 percent in Portland from a year earlier, while prices were up 20 percent.

The reason is lack of inventory, Hitz said. There just aren’t enough homes available to meet the demand, which is creating a minor frenzy every time an attractive property hits the market.

“For sellers it’s delicious, quite frankly,” he said.

Low housing inventory isn’t just a problem for buyers in southern Maine. Nationally, the number of homes for sale has been declining for the past year as more people are hanging on to their properties. Some are choosing to become landlords or list the property on short-term vacation rental websites such as Airbnb rather than sell it when they purchase a new home.

Some current homeowners are choosing to stay put because the market is so tight that they decide it isn’t worth it to sell the current home and attempt to buy another one, said Portland broker Chelsea Locke of Keller Williams Realty.

“People’s buying power has gone down a lot,” said Locke, former president of the Portland Board of Realtors. “A lot of times they’re getting the same or a little bit less than what they already have.”

At the same time, buyer demand has been increasing. That’s partly because homeowners whose homes lost value during the real estate crash of 2007 and 2008 are finally in an equity position to buy and sell again. Others went through home foreclosure, and their credit scores have now recovered sufficiently to get back into the market. Also, a number of millennials who initially held back on buying a home are taking the plunge.

According to the National Association of Realtors, homes listed for sale nationally sold faster on average during the first quarter than in any other quarter during the past decade. The reason was low inventory, it said.

SELLERS OWN THIS MARKET

In the Portland area, it is now a common occurrence for a seller to list the home on a Friday, hold an open house over the weekend and be sitting on multiple offers by Monday or Tuesday, Hitz said. Many homes are going under contract within five days of being listed, he said.

Hitz said he has begun holding back-to-back open houses for each home, on Saturday and Sunday, rather than a single open house on Sunday as he has done in the past.

The reason is that so many prospective buyers were showing up to each Sunday open house that Hitz was worried they would be intimidated by the amount of competition. Now, the crowds are split over two consecutive days, he said.

“I do it so the buyer doesn’t feel so hopeless,” Hitz said.

York real estate broker Greg Gosselin said there is currently a greater imbalance between housing supply and demand than he has ever seen. It’s not unusual for buyers to lose out on multiple attempts to purchase a home, he said, even if they are making offers that are above each seller’s asking price.

The market is especially challenging for first-time home buyers, who are not only competing with wealthy vacation-home buyers but also investors in rental properties who are coming in with cash offers. Cash buyers are heavily favored by sellers in the current market because cash deals do not require an appraisal, the brokers said.

“Investors are buying properties to rent them out,” said Gosselin, owner and designated broker of Gosselin Realty Group and president of the Maine Realtors Association. “When they can get these high rents, it’s a great opportunity for them.”

LITTLE TIME TO THINK THINGS THROUGH

The intense competition for available homes has led to some irrational buyer and seller behavior. Some buyers are making offers that are significantly higher than the home’s list price, which can be good for the seller but also can lead to a failed transaction or future financial problems for the buyer.

Home buyers are feeling pressure to submit offers that push the limits of their budget, and they are being given very little time to think it through, Gosselin said.

“They have to be quick to react,” he said. “They’ve got to be ready to look at a new listing just as soon as it hits the market.”

Hitz said an unrealistically high offer also can kill the sale transaction.

If a buyer submits an offer of $450,000 on a home that later only appraises for $425,000, the buyer will only be able to obtain financing based on the home’s appraised value.

For a conventional mortgage loan with a 20 percent down payment, the buyer offering $450,000 for a home appraised at $425,000 would be able to finance 80 percent of $425,000 – or $340,000. The other $110,000 would have to be paid in cash, and a lot of buyers don’t have that much on hand.

In another scenario, the buyer might submit an offer of $450,000 but then get cold feet when the home only appraises for $425,000. In either case, the deal falls through and the seller is back to square one.

Hitz said appraisers are taking a relatively conservative approach to valuing homes in Portland despite the intense demand. Otherwise home prices would be climbing even faster, he said.

“The appraisers are keeping us in check,” Hitz said.

‘WE REALLY NEED INVENTORY’

In some cases, sellers have gotten greedy and listed their homes for significantly higher than the likely appraised value, he said. That also has led to failed transactions and forced some sellers to ratchet down their asking price in order to complete a sale. In Cumberland County, the median original list price in May was about $315,000, but the median sale price was only $285,000.

The intense pressure and compressed timeline of the buying process also has led to multiple cases of buyer’s remorse, said Laura Sosnowski, owner and broker at Maine Home Connection in Portland.

“The buyer gets the offer, and then it’s like, ‘Oh my gosh – what just happened?'” she said. “‘I don’t even remember what (the house) looks like.'”

Laura Sosnowski, owner and broker at Maine Home Connection, says the intensity of the current market can sometimes lead to buyer’s remorse, so she always gives prospective buyers a chance to view a property again after an open house.

For that reason, Sosnowski said she always gives prospective buyers at least a day to come back and view the home again after the open house. Some brokers and agents don’t.

Despite those challenges, home sellers said they are thrilled with the current market conditions because it has never been easier to sell an appropriately priced home.

“We’re happy, of course, being the sellers,” said Falmouth resident Tracy Revoir, who is selling her home because the family is moving out of state. “Fewer people are actually listing their houses, so there’s less inventory, and there’s just fewer choices for buyers to make. So when they do find that perfect house, you’ve got five other people who are also finding that perfect house.”

It can be difficult for buyers to cope with the current situation, the brokers said. They recommend that buyers get pre-qualified for a mortgage and wait until they are serious before jumping into the frenzied market.

Locke said it helps to have an experienced real estate agent or broker who understands the current market and can help navigate its challenges.

“It’s so different that people are just kind of shocked by what they’re seeing,” she said.

Locke also made a plea to potential home sellers to help relieve the extreme supply shortage.

“If you’re even considering selling your home, call your Realtor, because we really need inventory,” she said.

J. Craig Anderson can be contacted at 791-6390 or at:

Twitter: jcraiganderson

Send questions/comments to the editors.

Comments are no longer available on this story