A Scarborough husband and wife who marketed and sold weight loss and dietary supplements with claims that federal officials called “a blizzard of lies” have been ordered to stop making false claims and engaging in deceptive practices.

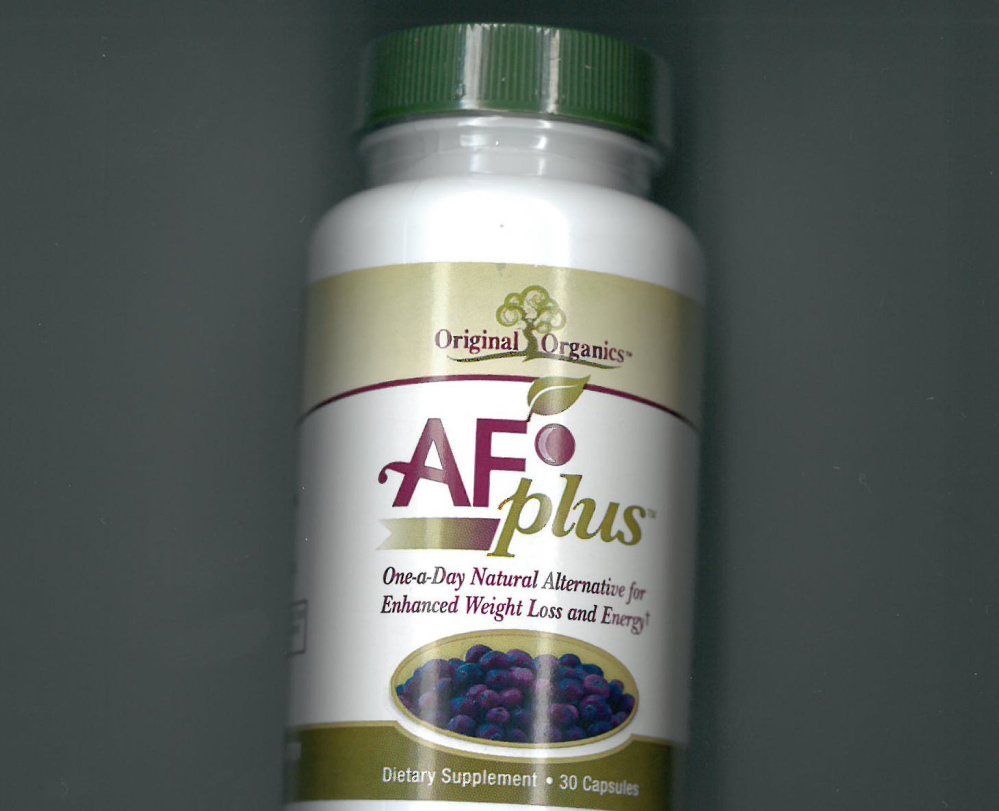

Anthony and Staci Dill, who sold pills under the names “AF Plus” and “Final Trim,” also must surrender many of their personal and business assets, according to the settlement announced Friday by the Maine Attorney General’s Office and the Federal Trade Commission.

A federal and state investigation found that the Dills fraudulently sold $16 million worth of weight loss products through two companies, Direct Alternatives and Original Organics LLC, over the last four years, promising that users of the products would easily lose a significant amount of weight and reduce their waist size.

The company, operating out of a second-floor office on Congress Street in Portland, also promised that the products were “proven” by scientific studies to work.

“This company preyed on the vulnerability of consumers who seek a legitimate weight loss program,” Attorney General Janet Mills said in a statement. “The conduct here is not limited to making false claims about their products; it also includes charging consumers hundreds of dollars in automatic monthly orders and making it very difficult for customers to cancel orders or get their money back.”

The Dills’ attorney, Daniel Mitchell, did not respond to a call or email for comment. A call to the couple’s home Friday was not answered.

According to the Attorney General’s Office, which filed a joint complaint with the FTC last month, the Dills used misleading radio ads to market their products.

One radio ad for the company’s products claimed: “With the metabolism-boosting benefits of AF Plus, you can keep eating your favorite foods and STILL lose pounds and inches – in fact we guarantee it.” Another claimed consumers would “experience maximum weight loss – pounds in days.” They consistently said their results were “proven,” but none of the claims was backed with scientific support.

“The Dills’ companies told a blizzard of lies,” said Jessica Rich, director of the FTC’s Bureau of Consumer Protection.

“They sold worthless weight-loss supplements, lied about their supposed ‘free trial’ offers, took people’s money with unauthorized auto-renewal plans, and made it nearly impossible to return their bogus products.”

The settlement, signed by a federal judge Friday, permanently bars the Dills from engaging in such practices in the future and requires them to forfeit some of the money they made.

The court order imposes a $16,419,989 judgment that will be suspended if the Dills liquidate many of their assets, including real estate, timeshares, a boat, snowmobiles, jewelry and cash from numerous investment accounts. The couple will not face criminal prosecution.

The company also promised consumers a 30-day “risk-free trial,” but then made it difficult to cancel orders and obtain a refund. The minimum purchase was two bottles of supplements, which cost $80, and customers had to return an unopened bottle at their own expense to receive the refund. They also were not refunded their initial shipping charge.

Customers also were enrolled in a monthly plan that continued to charge their credit cards, and those who called the customer service number were met with resistance, according to the complaint.

Maine will receive $500,000 of any restitution to pay back some customers. The rest will go to the FTC to help fund consumer protection programs, according to the complaint.

The defendants also deceptively promised $80 worth of Wal-Mart or Target gift cards to customers who agreed to trial memberships in two buying clubs. Customers never received the gift cards and were auto-billed $24.95 per month for each club if they didn’t cancel the memberships within 30 days, according to the complaint.

According to Mills, the case against the Dills was the first time the Attorney General’s Office and the Federal Trade Commission have collaborated on an enforcement action.

Send questions/comments to the editors.

Comments are no longer available on this story