Most Mainers buying Affordable Care Act insurance will see modest increases in their premiums for 2016, below the national average and much lower than the double-digit increases projected in some cities by a recent study of initial rate filings.

About 80 percent of the 75,000 Mainers purchasing ACA marketplace insurance have a plan through Lewiston-based Community Health Options – formerly Maine Community Health Options. The ACA marketplace, operated on the Web as healthcare.gov, is where those without insurance – often part-time or self-employed workers – can obtain subsidized benefits.

The average increase for a Community Health Options plan for 2016 is 0.5 percent, compared with a 0.8 percent decrease in rates in 2015, according to preliminary rate filings at the Maine Bureau of Insurance.

Anthem Blue Cross Blue Shield patients will see an average increase of 5.7 percent in 2016, and Harvard Pilgrim Health Care customers will experience an average decrease of 4.8 percent. Among the 20 percent of Mainers who don’t have insurance with Community Health Options, most have Anthem plans.

Aetna will offer plans on the ACA marketplace in Maine for the first time in 2016.

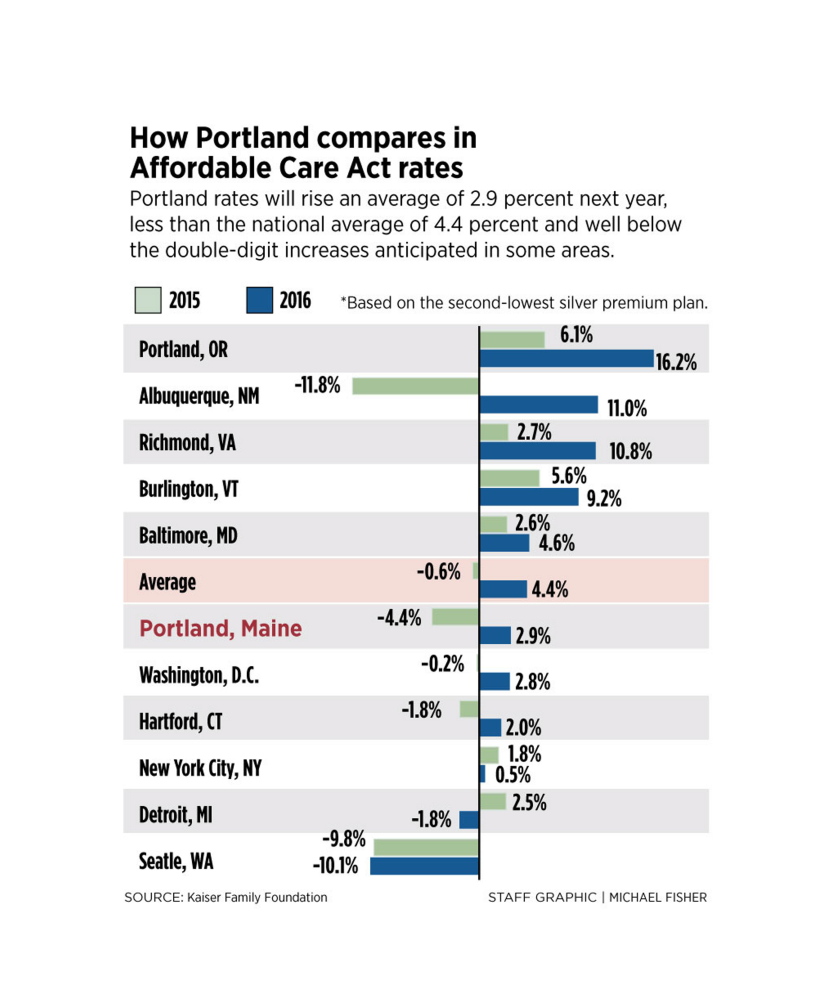

Community Health Options’ tiny rate-increase proposal echoes a Kaiser Family Foundation study released in June that shows the Portland metro region will have lower-than-average premium rate increases compared with a selection of metro areas across the country.

Although the rates could change in the coming months, Bureau of Insurance officials expect the revisions to be minor.

Kevin Lewis, executive director of Community Health Options, a nonprofit cooperative, said most people purchasing insurance will see nearly identical prices to last year if they stick to similar plans.

“What we are proposing is far less than medical cost inflation or even the (Consumer Price Index),” said Lewis, referring to the CPI, a national measure of the increasing costs of all goods. “This is a very meaningful proposal that puts the interests of consumers first.”

COMPETITION KEEPING PRICES DOWN

Rory Sheehan, an Anthem spokesman, said the insurance company was pleased to offer competitive rates.

“If approved, this average rate adjustment allows us to continue to offer some of the most comprehensive and innovative plans in the marketplace at an affordable and competitive price,” Sheehan said in a written statement.

All rate proposals must be approved by the Bureau of Insurance, and the insurers have more months of regulatory review and negotiations before rates are finalized later this year.

Emily Brostek, executive director of Consumers for Affordable Health Care, a health advocacy group, said Community Health Options’ domination of the marketplace is helping to suppress prices. The cooperative wants to maintain its commanding market share, and the other insurers must aggressively price to have a shot at knocking the cooperative off its perch.

“Competition plays a part, when one company is getting most of the enrollment and the others are trying to get market share,” Brostek said.

Some studies have shown that states with cooperatives – which is a member-run nonprofit – have successfully kept premiums lower than states that don’t. About half of the states have a cooperative.

The cooperatives were created under the Affordable Care Act as a way to provide competition to traditional insurance companies, with federal loans to help the co-ops get off the ground. Maine’s co-op received a $65 million loan. The cooperative’s governing board must include enrollees, who make up a majority of the board.

Brostek said Maine’s overall success at signing people up for marketplace coverage – Maine had one of the most robust sign-ups in the country – also is helping to keep a lid on rate increases.

“It’s not just the volume of people signing up. It’s a mix of ages and different health needs,” Brostek said. “Many people signed up for peace of mind and don’t have any immediate health concerns, and those people aren’t very expensive to insure.”

UNDER-35 SIGN-UP RATE HELPS MAINE

Brostek said that if mostly sick and older people had enrolled, it would be a more expensive pool of people to cover, and rates would be higher.

Thirty-three percent of Maine marketplace enrollees were under age 35, compared with the national average of 36 percent. Given Maine’s high percentage of elderly residents, Brostek said an impressive percentage of young people signed up for coverage.

In the Kaiser Family Foundation study, the nonprofit think tank compared proposed premiums for specific types of plans in selected metropolitan markets across the country, including Portland. The Portland metro region showed a 2.9 percent increase, less than the 4.4 percent increase projected nationally and well below the double-digit increase anticipated in some markets.

The study forecast a 16 percent rate increase, for example, in Portland, Oregon, and about 11 percent in Albuquerque, New Mexico, and Richmond, Virginia. On the other end of the scale, rates in the Seattle area are expected to go down by 10 percent.

Part of the dynamic, Lewis said, is that because the marketplace was new in 2014, insurers were projecting costs and did not have actual experience to fall back on to determine prices. Insurers that did not make accurate estimates of what the pool of patients signing up would look like would see larger fluctuations in prices. But in Maine, the estimates were close to what actually happened, he said.

Send questions/comments to the editors.

Comments are no longer available on this story