The average compensation for top executives at publicly traded companies in Maine has risen by 44 percent over the past five years. Still, the average pay package for a Maine-based president or CEO remains just a fraction of the national median.

Nationally, the median CEO compensation at publicly traded companies surpassed $10 million in 2013 for the first time in history, and CEO pay packages have increased in value each year for the past four years.

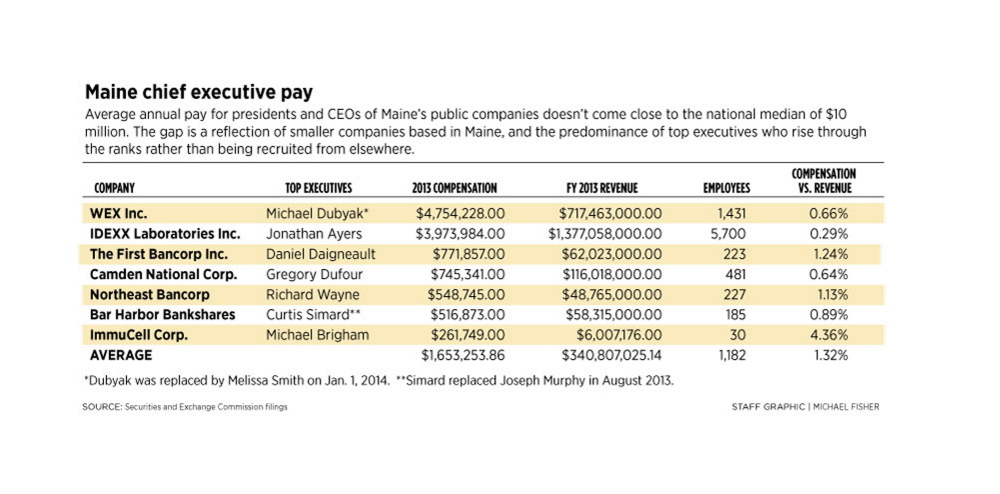

The same holds true in Maine, where salaries and benefits for the highest-paid presidents and CEOs at public companies have risen steadily from an average of $1.15 million in 2009 to $1.65 million in 2013, according to annual reports filed with the U.S. Securities and Exchange Commission.

Yet top executives in Maine make far less than many of their counterparts nationwide.

Reasons include the predominance of home-grown companies in Maine, often led by their founders, or executives who have risen through the ranks over a period of several years, executives and analysts said.

Also, most public companies in Maine are relatively small, including a handful of regional banks, they said. There are nine public companies based in Maine, but only seven trade on major stock exchanges and report their executive compensation to the SEC.

Smaller companies generally are more accountable, efficient and transparent about their finances, said ImmuCell Corp. CEO Michael Brigham, the lowest-paid CEO of a Maine-based public company in 2013.

Brigham, who made $261,749 that year, said top executives at the nation’s largest public companies are overpaid.

“I don’t think anyone’s worth that kind of money,” he said. “I don’t care how good you are.”

The highest-paid CEO at a publicly traded company based in Maine earned less than half the typical compensation of his peers across the nation in 2013.

In his last full year at the helm of WEX Inc., President and CEO Michael Dubyak earned $4.7 million in total compensation, far below the $10.5 million compensation reported as the U.S. median for CEOs of public companies.

Dubyak’s pay fluctuated significantly over the past five years, although 2013 was his best year. In 2010, Dubyak received $4.2 million in compensation, while in 2012 he received $2.5 million. Dubyak was replaced in January by the company’s current CEO, Melissa Smith.

Maine’s second-highest-paid top executive in 2013, Idexx Laboratories Inc. Chairman, President and CEO Jonathan Ayers, also has seen his compensation fluctuate over the past five years, from a high of $8.7 million in 2011 to a low of $2.6 million in 2009.

Still, aside from 2011, in which he received $6.5 million worth of stock options, Ayers’ compensation has trended upward each year.

Overall, the average compensation received in 2013 by presidents and CEOs of Maine’s seven public companies that trade on major stock exchanges was less than one-fifth the national median.

Because of the small sample size in Maine, average compensation is a better gauge than the median, which is the number halfway between the highest and lowest salaries.

The median public-company CEO compensation in Maine was $771,857, which The First Bancorp Inc. President and CEO Daniel Daigneault received in 2013.

Nationally, the typical CEO makes about 257 times the salary of the average worker, a sharp rise from 181 times in 2009, according to a study by The Associated Press and California-based research firm Equilar.

Maine’s public companies do not disclose average employee salaries, but industrywide data suggest a far smaller gap between CEO and average worker pay in Maine, at least at Maine banks.

Four of the seven major publicly traded companies in Maine are regional banks. According to the U.S. Department of Labor, the average salary for a bank employee nationwide is $49,540.

The average bank CEO compensation in Maine was $645,704 in 2013, just 13 times the average bank worker’s pay.

Edward McKersie, founder and president of Maine-based executive search firm Pro Search, said there are several reasons why Maine’s top executives earn less than the national median.

Huge companies in places such as New York and Silicon Valley skew the national median because of their massive CEO compensation packages, Mc- Kersie said.

Another reason is that most U.S. companies hire CEOs from outside the organization, which usually requires a larger sum to lure them in, he said.

In contrast, most of Maine’s top executives are homegrown.

“If they had to hire a CEO from outside, it probably would cost them a lot more,” McKersie said.

Another factor is that Maine’s four banks that trade on major exchanges are smaller, regional operations, he said.

“They have almost nothing in common with the CEO of Bank of America, or American Express,” McKersie said.

That also explains why the presidents and CEOs at Maine banks earn no more than 15 times the average employee salary, he said.

“The relatively small size means there aren’t that many layers between the CEO of the company and the tellers at the company,” McKersie said.

Despite being paid far less than the national median, top executives in Maine are still doing just fine financially, McKersie said.

“Nobody’s feeling sorry for them,” he said. “They make a good living.”

J. Craig Anderson can be contacted at 207-791-6390 or:

canderson@pressherald.com

Twitter: jcraiganderson

Send questions/comments to the editors.

Comments are no longer available on this story