Maine Community Health Options, the co-op that’s competing for customers in the state’s new health insurance marketplace, is so far capturing nearly three of every four people who are signing up for benefits through www.healthcare.gov, the co-op’s top official said Thursday.

It’s unknown why the startup nonprofit is drawing more customers than Anthem Blue Cross Blue Shield, a longtime health insurance provider in the state. The premiums and deductibles for both are largely similar.

Kevin Lewis, executive director of Maine Community Health Options, said 73 percent of the 1,727 Mainers who signed up for insurance in the marketplace through Nov. 30 chose co-op plans over Anthem.

Lewis said that market-share dominance in the first two months of the marketplace exceeded expectations. Rough projections from the fall, before the marketplace opened on Oct. 1, suggested that each insurer would get about half of all customers.

“It speaks to the value we bring to Maine people, the design of the plans, the value we bring and the price,” Lewis said.

He said it’s difficult to say whether his organization’s market share will change substantially as more people enroll. Glitches in healthcare.gov prevented many potential customers from signing up in October, but the website began running more smoothly in mid-November.

December numbers, to be released in mid-January, are expected to reveal a substantial increase in enrollment, Lewis said. Whether those late filers will opt for Anthem or Maine Community Health Options is “the $64,000 question,” he said. “We don’t know yet.”

So far, he said, numbers indicate that more people in their 40s and 50s are signing up for health insurance, and not as many young people.

Anthem officials did not respond directly to questions about the disparity in customers, but said the numbers are fluid as enrollment continues.

“While we cannot confirm exchange enrollment numbers at this time, we continue to see significant interest from current and prospective (consumers) in Anthem products on the exchange,” Rory Sheehan, an Anthem spokesman, said in a written statement.

Consumers, including many part-time or self-employed workers, can buy subsidized insurance on the marketplace, also called the health insurance exchange. Those who are uninsured next year will be subject to a tax penalty.

Maine Community Health Options announced Thursday that it will extend its deadline to Dec. 31 for consumers who want coverage starting Jan. 1. President Obama asked insurance companies last week to push the deadline back from Dec. 23 to New Year’s Eve.

Anthem Blue Cross Blue Shield will stick with the Dec. 23 sign-up deadline, company officials said.

Nationally, it’s too early to tell how well the co-ops, which were formed with $2 billion in federal loan money, will perform relative to traditional, for-profit insurance companies with plans in the marketplace, said John Morrison, president of the National Alliance of State Health Co-Ops, a trade association.

The co-ops were created under the Affordable Care Act to give consumers an alternative to traditional insurance companies. While they were initially planned in most or all states, federal cutbacks limited the co-ops to 23 states.

Morrison said that, at least anecdotally, some co-ops are capturing significant market share. In South Carolina, for instance, the co-op plan got 65 percent of the consumers who enrolled in the first month, according to the co-op, Consumers’ Choice Health Plan.

Morrison said that, aside from price, consumers feel better about spending money with state-based, nonprofit groups than with private insurers.

“The management model of the co-ops is appealing to many if not most consumers,” he said, and with a nonprofit, extra revenue is plowed back into the organization, rather than kept as profit.

Jessyca Broekman and Al Aucella of Falmouth, a married couple in their 50s, chose Maine Community Health Options over Anthem for a number of reasons – and the price wasn’t one. They said they found that customer service was better with Maine Community Health Options.

While both insurance providers offered similar costs, “We preferred to go with a nonprofit,” Broekman said. “That sat well with us.”

The self-employed couple – Aucella is a financial consultant and Broekman is a website designer – will cut their health insurance costs in half on the exchange, and “we have much better coverage,” Broekman said.

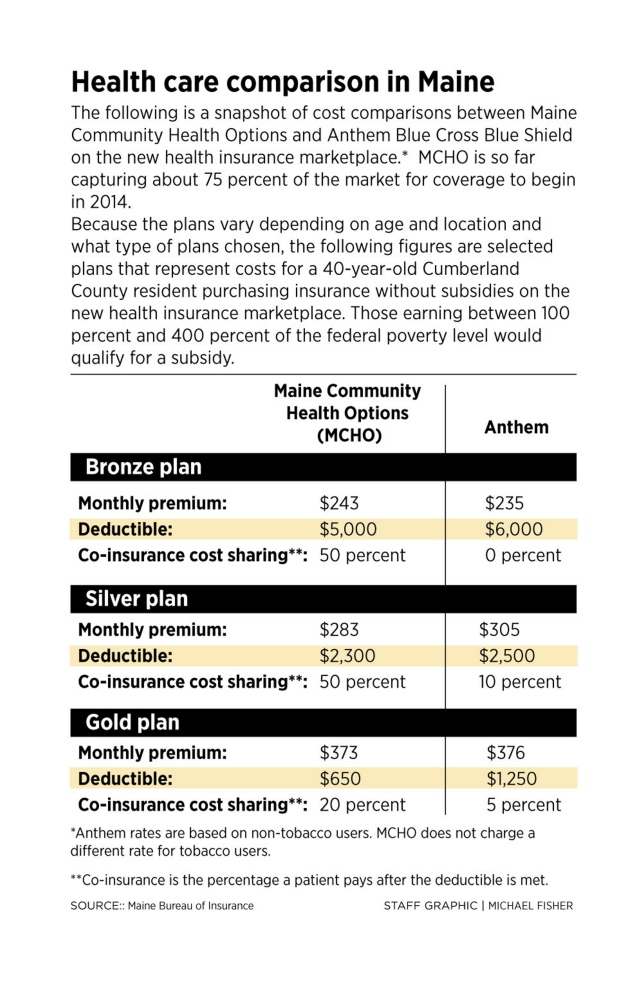

The prices of the plans are similar, although Maine Community Health Options tends to have lower premiums based on the voluminous number of plans it offers, according to the Maine Bureau of Insurance website.

Total costs for each customer also depend on deductibles and co-insurance cost sharing, which is the cost to clients for medical procedures after the deductibles are met. The cost sharing tends to be lower for Anthem plans.

Joe Lawlor can be contacted at 791-6376 or at:

jlawlor@pressherald.com

Twitter: @joelawlorph

Send questions/comments to the editors.

Comments are no longer available on this story