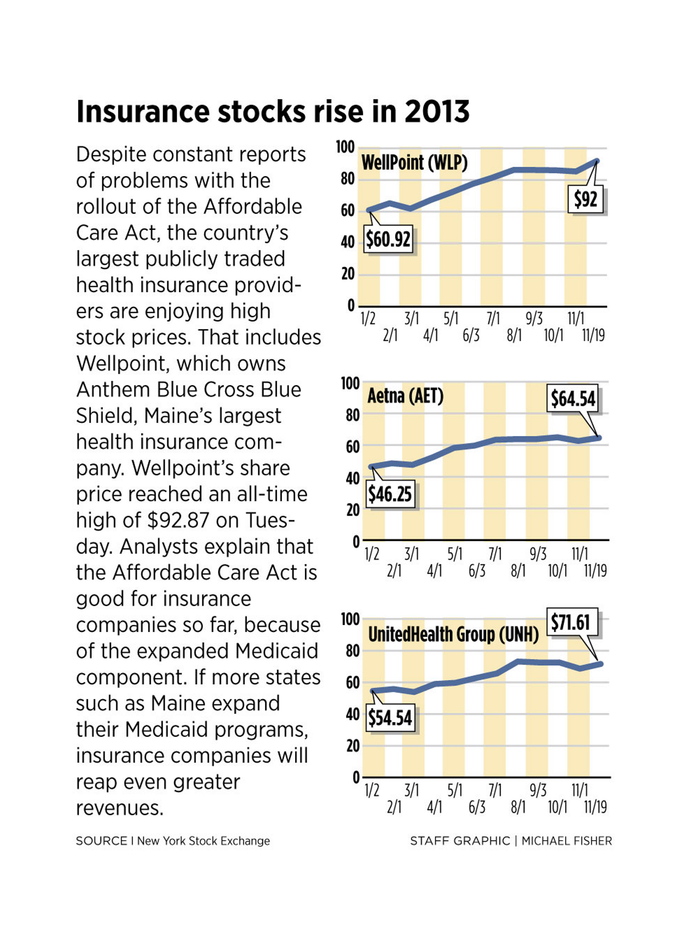

Despite problems with the rollout of the Affordable Care Act, including a disastrous launch of the website that individuals use to buy health insurance, share prices for the country’s largest publicly traded health insurance companies are at or near all-time highs.

That includes Indianapolis-based WellPoint Inc., which owns Anthem Blue Cross Blue Shield, Maine’s largest health insurance provider. Shares of Wellpoint hit a record price of $92.87 on Tuesday.

Other health-insurance stocks, including UnitedHealth Group, Aetna Inc., Cigna Corp. and Humana Inc., have shown similar gains.

Why are investors so bullish about the much-maligned Affordable Care Act’s impact on health insurance companies? Analysts say the federal health care law appears to be good for large insurance companies so far, primarily because of its expansion of Medicaid.

In recent decades, most states, including Maine, have outsourced management of all or part of their Medicaid programs to companies known as managed care organizations. Most major health insurance companies operate such organizations. Last December, WellPoint dramatically expanded its Medicaid management business by acquiring the Amerigroup managed care organization for $4.9 billion.

The Affordable Care Act’s Medicaid expansion is expected to provide billions of additional dollars to the largest providers of managed care, stock analysts said. If more states expand their Medicaid programs, the expectation is that insurance companies will reap even more revenue, they said.

So far, 26 states have opted to expand their Medicaid programs. The White House has been applying political pressure to the other states, including Maine, to follow suit.

Another factor boosting health insurance stocks is the belief that insurance companies ultimately will gain millions of new customers through the Affordable Care Act’s federal- and state-run health insurance marketplaces. However, analysts say most major health insurance companies are taking a conservative approach to getting involved in the marketplaces, because they don’t yet know what the typical buyer will be like.

Before the Affordable Care Act, insurance companies avoided individual and small-group customers who were likely to need extensive medical care, such as those with pre-existing conditions, Dr. Don McCanne, of Physicians for a National Health Program, said in a commentary on the Chicago-based group’s website. Now, companies operating in the marketplaces have to take whoever comes, he said.

“Obamacare now prohibits selective enrollment – cherry picking and lemon dropping,” McCanne said. “Insurers rightfully fear that those with greater health care needs will rush into the exchanges, creating high-cost risk pools that would price premiums out of the market.”

Large insurers’ relative lack of participation in the marketplaces – most insurers are active in just a handful of states – isn’t likely to have much impact on their bottom lines because individual and small-group plans represent just a small fraction of their business, experts say.

Stock analyst Chris Bailey noted in a report for the investor website Seeking Alpha that large insurers don’t really need to participate in the health insurance marketplaces to remain profitable.

“They are specialized in providing insurance to big employers, not the individuals and small businesses that will be served by the exchanges,” Bailey said.

Jason Allen, president of the Maine Association of Health Underwriters, said he is concerned that some of the Affordable Care Act’s mandates are driving premiums well above what many consumers would consider affordable. Those include requirements that no customer be denied coverage because of a pre-existing condition, and that parents be allowed to keep children on their plans until the children turn 26.

Allen said he thinks that some of the rules will have to change to make individual coverage affordable to the average person.

Large, publicly traded insurance companies are likely to stick little more than a few toes in the waters of the marketplaces until those issues are resolved, analysts said. The real growth opportunity for large insurers is in expanded Medicaid.

According to Kaiser Health News, large health insurance companies such as WellPoint got a major boost in stock prices in June 2012 when the U.S. Supreme Court ruled that the Affordable Care Act is largely constitutional.

Those stock prices likely would have gone even higher if the court had ruled in favor of nationwide Medicaid expansion, rather than leaving it to each state, according to Kaiser.

Even with the Congressional Budget Office’s estimate for expanded Medicaid enrollment reduced from 13 million to 7 million in light of the court’s decision, that’s a lot of new customers for managed care organizations to pick up, said Dee Gill, an analyst with Seeking Alpha.

“Shareholders in Medicaid management companies already raked in big money this year, even though much of the nation still waits for the government to build a working website for insurance sales,” she said.

J. Craig Anderson can be contacted at 791-6390 or at:

canderson@pressherald.com

Twitter: @jcraiganderson

Send questions/comments to the editors.

Comments are no longer available on this story