PORTLAND – Larissa Montminy had one word Monday for the price of the gas she put into her new Honda Civic at a Sunoco station on Forest Avenue.

“Awful,” said Montminy, who is 20 and works two jobs, as a community assistant and a waitress.

Montminy paid about $37 for 10 gallons of gas Monday. She said she usually looks for the lowest price and her 2013 Civic gets good mileage, but she has noticed that her regular 108-mile trip from Bangor to Auburn to visit family is noticeably more expensive.

Her trip is likely to cost even more, with summer tourists in Maine and political unrest in Egypt the biggest factors pushing the state’s gas prices above the national average in recent days, industry analysts said.

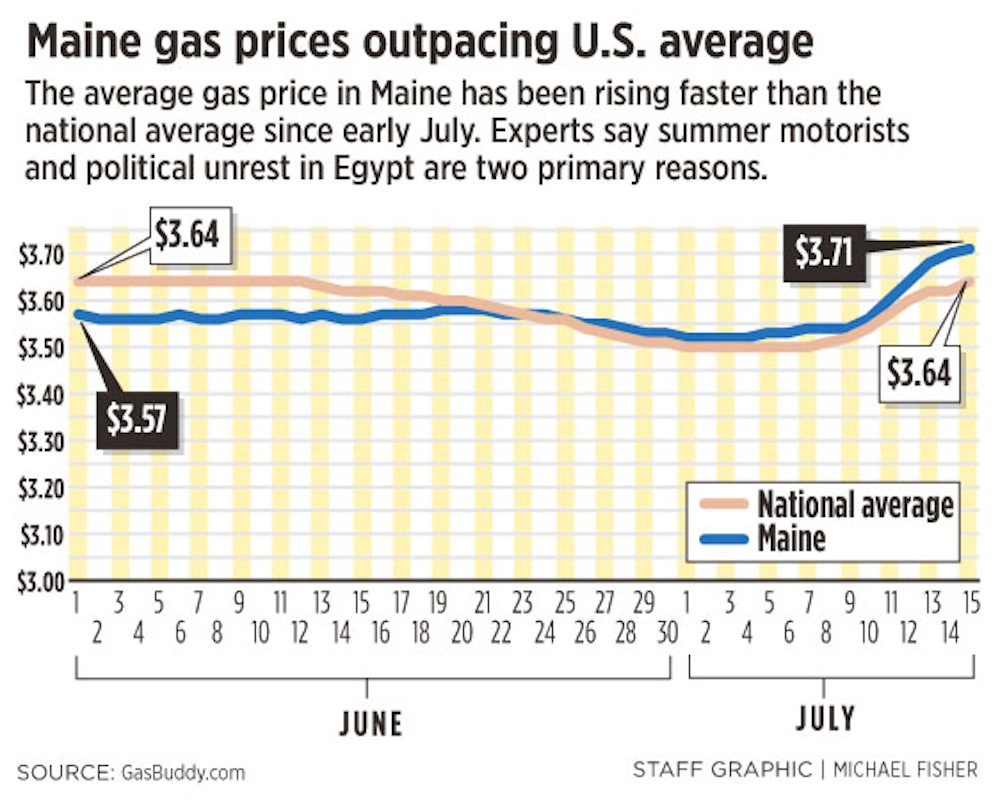

Maine’s average price for regular gas was $3.71 per gallon Monday, about 7 cents more than the national average, according to the Minnesota-based gas price analysis firm GasBuddy.com.

A month ago, Maine’s average price was $3.58, according to GasBuddy.com, while the national average was just under $3.64.

One of the biggest contributors to gas price fluctuations is the price of crude oil. The average price for a barrel of crude has increased about 8 percent in the past month, from $98 to $106, according to GasBuddy.com.

Reasons for the price spike in Maine are numerous, but they boil down to two basic categories: increased demand, and the perception that supply could decrease in the near future, said Charles Colgan, professor of public policy and management at University of Southern Maine’s Muskie School of Public Service.

In Maine, as in other states in the region, demand for gasoline increases in the summer as more people take to the roads for local and cross-country trips, he said.

As demand approaches the maximum amount that regional refineries can produce, it drives up prices at the pump, Colgan said.

“We’re at the peak limit for refining capacity right now,” he said.

Demand for gas in Maine is likely to remain at that peak for the next six weeks, until tourism begins to taper off, Colgan said.

On the supply side, motorists in Maine are paying for Egypt’s political instability in the form of what Colgan called a “risk premium.”

Unlike states in the Southeast that get a large portion of their gasoline from crude oil drilled in the Gulf of Mexico, most of Maine’s petroleum comes from the Middle East and Canada, he said.

At the moment, investors are betting on a possible disruption in the supply of oil from the Middle East because much of that supply — 3 million barrels a day — passes through Egypt’s Suez Canal on its way to the U.S. and Europe, Colgan said.

The recent overthrow of Egyptian President Mohamed Morsi and uncertainty about the type of government that ultimately will take power in that country have led investors to drive up the price of oil futures on speculation that the supply passing through Egypt will be disrupted, petroleum analysts have said.

“The oil coming through the Suez Canal is an issue for Maine and the Northeast, because we do get oil from the Suez Canal,” Colgan said.

Analysts’ predictions that gas prices could increase another 25 to 30 cents in the coming month aren’t unrealistic, he said, even though it’s unlikely that Egypt would shut down the Suez Canal, since its revenue represents about half of the country’s gross domestic product.

“When people have concluded that the risk was overblown … prices will decrease again,” Colgan said.

Aaron Truman put $10 worth of gas in his mom’s van Monday at a station on Broadway in South Portland, paying $3.80 a gallon. That probably didn’t fill one-fifth of the tank, he said.

Truman, 18, drives a Dodge Durango that gets 14 mpg. If prices go up any more, he said, he will cut down on driving.

“I won’t be driving anywhere, except going to work. It’s just too expensive,” he said. “I mean, just going to the mall and back is going to cost $10.”

In Westbrook, Brenda Broder said that, with higher gas prices, she tends to ride her motorcycle rather than drive her car, weather permitting.

“With my motorcycle, I’m not as concerned about it,” the self-employed hairstylist said while straddling her Suzuki Savage motorcycle. “I get about 120 miles out of 2½ gallons.”

Joe Curran, a cab driver for 207 Taxi, said higher prices take a bigger cut out of his bottom line, because drivers have to pay for their own gas.

Cab drivers can raise their fares only by petitioning the city, Curran said. And in his eight years of driving, that has happened only once, so the only thing to do is watch a bigger chunk of profits go to gas, offset a bit by the busier summer tourist season.

“It’s just a necessary evil,” said Craig Cobbett, the mechanic for 207 Taxi. “You can’t really combat the prices.”

Cobbett does try to reduce costs for the drivers. He said regular maintenance like keeping the oil changed and the right amount of pressure in the tires can get extra miles out of each gallon.

The taxis get about 16 miles to the gallon, and a driver usually pays up to $40 for gas per 12-hour shift, Curran said. That means about $800 a month in gas expenses alone. If that goes up, the cab drivers will just be out more.

A number of other factors affect gas prices, said Colgan and Gregg Laskoski, a senior petroleum analyst for GasBuddy.com who is based in Tampa.

Weather can have a huge effect on price fluctuations, especially in areas that are prone to hurricanes and other natural disasters, Laskoski said. The threat of a hurricane can force offshore oil rigs to shut down and evacuate for as long as a week, he said, disrupting the supply of domestic oil.

Damage to coastal oil refineries from hurricanes such as Katrina and Sandy has an even longer-lasting effect, he said, because it can take weeks to get those operations back to full capacity.

In Maine, weather’s effects on gas prices tend to be less dramatic but still very real, the analysts said. For instance, a prolonged summer heat wave tends to drive up prices because people are more likely to travel by motor vehicle, Laskoski said.

Gas prices also can spike when winter weather comes later than usual or is milder than expected, Colgan said.

Refineries in Quebec and Ontario, which provide both petroleum and heating oil to Maine, decrease production of gasoline each winter and increase heating-oil production.

Mainers drive much less during cold weather and instead use more heating oil, he said, but if temperatures remain mild, it can result in a gasoline shortage.

“If they time it wrong, you can get a negative effect on prices,” Colgan said about the transition from gasoline to heating-oil production.

Taxes and government regulation also affect gas prices, although in predictable ways, Laskoski said. For instance, Maine residents pay about 50 cents per gallon in state and federal taxes when they buy gas, he said, about 10 cents more than the national average.

Because of federal mandates for the use of cleaner-burning fuel additives from May 1 to Sept. 30, consumers across the U.S. tend to pay more for gas in the summer than they do in the winter, Laskoski said.

“That’s why we usually see the lowest price of the year in the fourth quarter,” he said.

Investor activity also plays a major role in the price of gasoline.

Investors buy crude-oil futures for a variety of reasons, Laskoski said, including the belief that oil prices will increase, or as a hedge against other potential losses such as a weakening of the U.S. dollar.

Therefore, when the dollar’s global value declines, gas prices tend to go up, Laskoski said, with no relation to the balance of supply and demand.

One of the only sure-fire ways to reduce the price of gas is to descend into a deep economic recession, Laskoski said.

“Everybody wants low gas prices, but you’ve got to be careful what you ask for,” he said.

— Staff Writer Karen Antonacci contributed to this report.

J. Craig Anderson can be contacted at 791-6390 or at:

canderson@pressherald.com

Twitter: @jcraiganderson

Send questions/comments to the editors.

Comments are no longer available on this story