Living through this economic downturn sometimes feels a little like being one of those trapped Chilean miners: We’re told that help is on the way, but it’s so far off it’s hard to see how we are going to hang on long enough to benefit from it.

Last week’s economic news was dismal. Growth for the second quarter of this year was revised down by the government from the 2.4 percent reported earlier to 1.6 percent.

The good news was that the number was not even lower, but that is little comfort. We are perilously close to a situation similar to what Japan experienced in the 1990s, where slow growth led to a decline in prices and a cycle that became known as “the lost decade.”

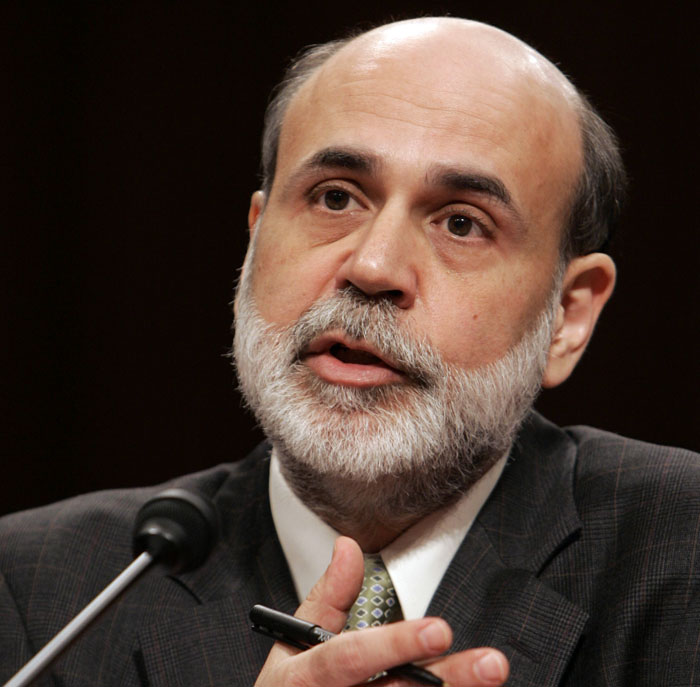

On Friday, Federal Reserve Board Chairman Ben Bernanke was more upbeat, saying that deflation was not a “significant risk for the United States in the near term” but that the Fed would “strongly resist deviations from price stability in the downward direction.”

That is Bernanke’s strongest statement to date that he would step in and prevent the economy from getting stuck in a deflationary spiral.

His attempts to sound optimistic were less encouraging.

The economy, he predicted, would continue to grow, “albeit at a relatively moderate pace,” which is a nice way to say very, very slowly.

Stronger household finances, rising incomes and easing of commercial credit would increase demand and consumer spending, creating the building blocks of faster growth next year. That’s what it will take to boost growth to the point where we start adding jobs in the numbers needed to cut into the pool of unemployed and underemployed Americans.

Some of them have been hanging on for nearly two years now, and telling them it may be another year before we start seeing real progress tempers any good news.

But like those miners in Chile, there’s not much more that we can do about it but wait.

Send questions/comments to the editors.

Comments are no longer available on this story