As its financial crunch worsened in November, Verso Paper Corp. marketed four of its eight mills, including the Androscoggin Mill in Jay, to potential buyers before deciding instead to file for bankruptcy and restructure its $2.4 billion debt.

The company’s attempt to sell the mills was disclosed in a presentation it made to lenders this month when it was seeking money to finance operations and pay bills while it works through bankruptcy proceedings. The presentation was included in a filing with the U.S. Securities and Exchange Commission.

Verso said it recognized in November that it was running out of money and decided to market the Jay mill’s paper and hydro operations and also sought to sell three NewPage mills, none of which is in Maine. Verso acquired NewPage in 2014 by taking on $2.4 billion in debt that requires interest payments of $270 million a year, the company said in the presentation.

Although the mills attracted attention from buyers, according to Verso, the company decided on another course. Instead of seeking a cash infusion through selling the mills, it opted to revamp its finances by seeking to restructure the debt through a bankruptcy filing.

Wednesday, a statement from the company said it is considering a restructuring plan that would eliminate the $2.4 billion debt in return for “substantially all” of the equity in the company. In other words, its major debt holders would become the company’s new owners.

In a statement released Wednesday morning, the company said “at least a majority” of the debt holders had agreed to terms of the restructuring process.

Striking that deal means that Verso could complete the bankruptcy process relatively quickly. The company’s statement said it hopes to get court approval for the restructuring and emerge from bankruptcy in about six months.

The company also is seeking court approval for $600 million in financing that it would use to pay expenses while it works through the bankruptcy process. The fund would be administered by Citibank, according to court documents.

The company said it doesn’t expect to sell or close any of its currently operating mills, but that it is exploring its options for a previously closed mill in Kentucky.

THOUSANDS OF CREDITORS

Verso is headquartered in Tennessee and owns the mill in Jay, which employs about 550 people. The company is incorporated in Delaware and filed for reorganization and protection from creditors in federal bankruptcy court in Delaware.

The company has thousands of creditors in addition to the debt holders. Among its largest Maine creditors are Catalyst Paper Operations in Rumford, which is owed $2.2 million, and Hartt Transportation Systems of Bangor, which is owed $1.2 million.

Verso Paper sold off its unprofitable Bucksport mill in 2014, eliminating 500 jobs. The move was part of a complicated $1.4 billion deal that involved the acquisition and then sale of the former NewPage mill in Rumford in January of last year. That mill is now owned by Canada-based Catalyst Paper.

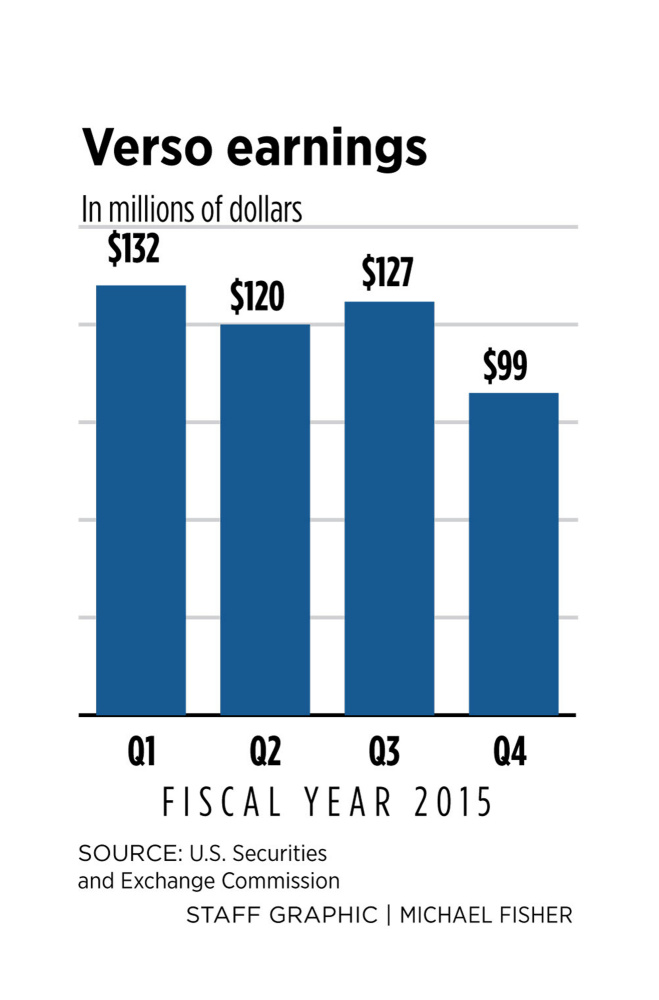

After that deal was concluded, Verso had about $3.5 billion in annual sales and about 5,800 employees in eight mills across six states. In its bankruptcy filing, the company reported gross revenues of about $2.4 billion for the first three quarters of 2015, suggesting that revenues for the full year had dropped.

The company said the Jay mill was the least profitable among the eight mills owned by Verso Paper and NewPage in 2015, and that its ranking is expected to rise to third-most-profitable this year. The mill laid off 300 workers in August 2015.

PAPER MARKET DECLINES

But in its presentation for lenders, Verso offered a bleak picture of the paper industry, saying the market for domestically produced paper shrank 8 percent from 2014 to 2015 because of the strong dollar, cheaper imports and reduced demand.

The acquisition of NewPage was financed primarily through borrowing, but the company has had trouble keeping up with the payments on that debt. Two weeks ago, the company told federal securities regulators that it was exercising a five-day grace period on a payment due on a $731 million loan. The next day, it notified the Securities and Exchange Commission that is was exercising a 30-day grace period on interest payments due on $1.3 billion in secured notes.

While that huge debt and the need to restructure it was the underlying reason for the bankruptcy filing, Verso also blamed a recent “accelerated and unprecedented decline in demand” for the company’s coated paper products, as well as strong foreign imports because of the strength of the U.S. dollar – which improves the purchasing power of American companies.

Demand for almost all paper goods has declined in recent years, but the market for coated paper – used for catalogs and magazines – has shrunk the most. The demand for coated paper has dropped by 30 percent to 50 percent since 1999, according to Jesse Marzouk, an industry analyst for Hilco Global, a financial services company.

Mills in Maine have also been hit by high energy costs, particularly for natural gas, in recent years, and by competition from Canadian mills making the same types of paper that Maine mills produce.

Staff Writer J. Craig Anderson contributed to this report.

Edward D. Murphy can be contacted at 791-6465 or at:

emurphy@pressherald.com

Send questions/comments to the editors.

Comments are no longer available on this story